As the cycle of uncertainty continues to yield confusion than clarity, investors are again caught having to decide between taking an offensive and defensive posture in the market. The tough part in today’s market environment is how fast situations can shift. With headlines driving the action, sentiment can flip on a dime. So how do you position yourself when breaking ...

Join Dave as he shares how he uses the power of Fibonacci retracements to anticipate potential turning points. He takes viewers through the process of determining what price levels to use to set up a Fibonacci framework, and, from there, explains what Fibonacci retracements are telling him about the charts of NCLH, RTX, and the S&P 500 This video originally ...

The stock market has been on quite the rollercoaster of late, thanks to news headlines. But investors seem to have shrugged off the past weekend’s geopolitical tensions, at least for now. On Tuesday, we saw a surge of enthusiasm. Investors were diving back into stocks and selling off their oil and precious metals holdings. Last week, oil prices spiked amid ...

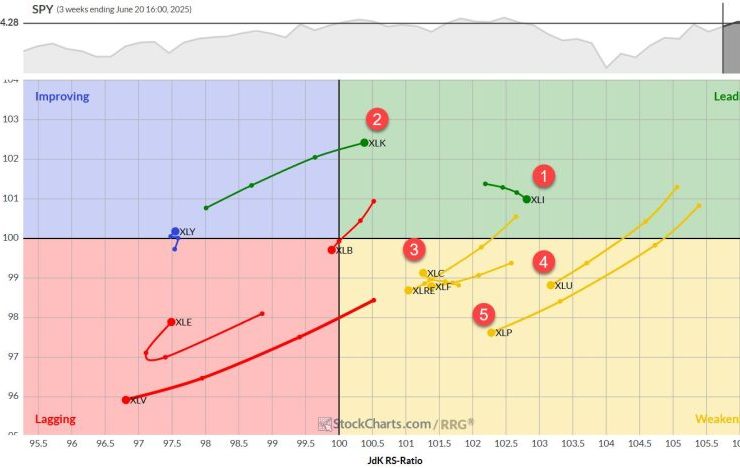

Some Sector Reshuffling, But No New Entries/Exits Despite a backdrop of significant geopolitical events over the weekend, the market’s reaction appears muted — at least, in European trading. As we assess the RRG best five sectors model based on last Friday’s close, we’re seeing some interesting shifts within the top performers, even as the composition of the top five remains ...

This week, we’re keeping an eye on three major stocks that are reporting earnings. Two of them have been beaten down and are looking to turn things around, while the third has had a tremendous run and is looking to keep its extraordinary momentum going. Let’s take a closer look at each one. Could FedEx Be Ready for a Comeback? ...

In this video, Mary Ellen opens with a look at the S&P 500, noting that the index remains above its 10-day average despite a brief pullback—a sign of healthy market breadth. She points to ongoing sector leadership in technology, while observing that energy and defense stocks are breaking higher and offering fresh opportunities. From there, Mary Ellen shares stocks that ...

In today’s “Weekly Market Recap”, EarningsBeats.com’s Chief Market Strategist Tom Bowley looks ahead to determine the likely path for U.S. equities after the weekend bombing of Iran nuclear sites. Are crude prices heading higher? Will energy stocks outperform? What additional roadblocks might we have to negotiate after the latest Fed meeting and policy statement? Could we see fallout from June ...

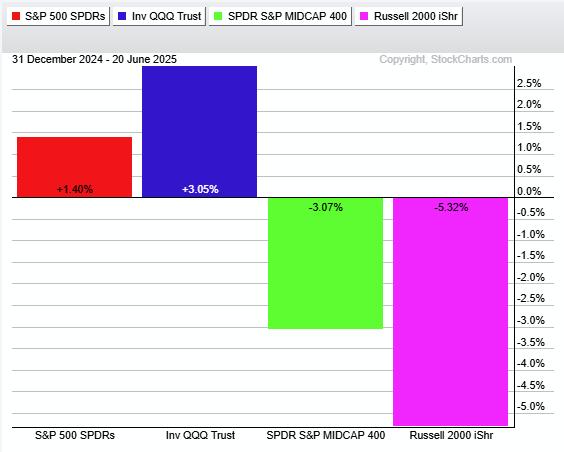

The S&P MidCap 400 SPDR (MDY) is trading at a moment of truth as its 5-day SMA returns to the 200-day SMA. A bearish trend signal triggered in early March. Despite a strong bounce from early April to mid May, this signal remains in force because it has yet to be proven otherwise. Today’s report will show how to quantify ...

U.S. stocks are on the cusp of a very impressive breakout to all-time highs, but are still missing one key ingredient. They need help in the form of a semiconductors ($DJUSSC) breakout of its own. When the DJUSSC reached its all-time high on June 20, 2024, one year ago, a nasty bearish engulfing candle printed on extremely heavy volume, I ...

This week, Julius breaks down the current sector rotation using his signature Relative Rotation Graphs, with XLK vaulting into the leading quadrant while utilities and staples fade. He spotlights strength in the technology sector, led by semiconductors and electronic groups that are outpacing the S&P 500. Microchip heavyweights AMD, NVDA, and AVGO are displaying bullish RRG tails, reinforcing the trend. ...