When sector performance shifts gears from one day to the next, it’s best to be prepared with a handful of stocks from the each of the sectors. In this hands-on video, David Keller, CMT, highlights his criteria for picking the top stocks in 10 of the 11 S&P sectors. Discover the importance of trends, moving averages in the right order, ...

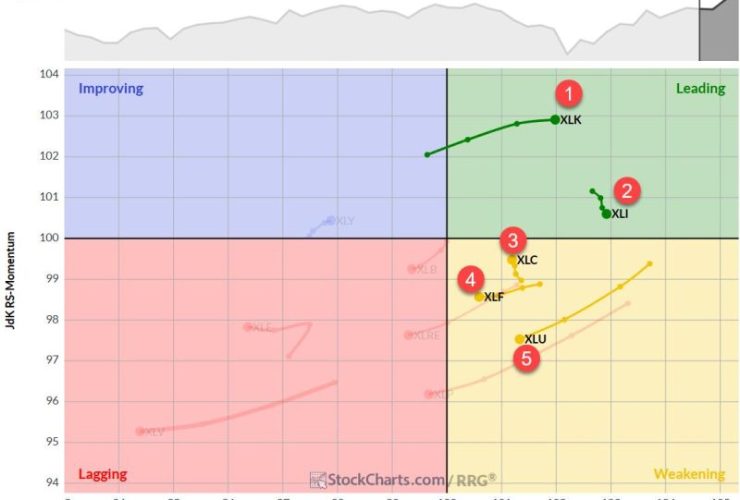

After months of whiplash sector swings, the market may finally be showing signs of settling down. In this video, Julius de Kempenaer uses Relative Rotation Graphs (RRG) to analyze asset class rotation at a high level and then dives into sectors and factors. Julius highlights the rotation into cryptocurrencies and the S&P 500, followed by an analysis of the S&P ...

A good trade starts with a well-timed entry and a confident exit. But that’s easier said than done. In this video, Joe Rabil of Rabil Stock Research reveals his go-to two-timeframe setup he uses to gain an edge in his entry and exit timings and reduce his investment risks. Joe shows you how he spots the big trends on a ...

For those who focus on sector rotation, whether to adjust portfolio weightings or invest directly in sector indexes, you’re probably wondering: Amid the current “risk-on” sentiment, even with ongoing economic and geopolitical uncertainties, can seasonality help you better anticipate shifts in sector performance? Current Sector Performance Relative to SPY To find out, let’s first look at how sectors are performing ...

Just when we thought tariff talk had gone quiet, it’s back on center stage. With the reciprocal tariff deadline landing this Wednesday, President Trump has mailed out notices that new duties will kick in on August 1. Countries such as Japan, South Korea, Malaysia, and Kazakhstan face a 25% levy, while a few others may see steeper rates. Wall Street ...

The past week has been relatively stable in terms of sector rankings, with no new entrants or exits from the top five. However, we’re seeing some interesting shifts within the rankings that warrant closer examination. Let’s dive into the details and see what the Relative Rotation Graphs (RRGs) are telling us about the current market dynamics. Sector Rankings Shuffle The ...

I like to trade stocks that are relative leaders and belong to industry groups that are leaders as well. For the past 2-3 months, much has been written about and discussed with respect to semiconductors ($DJUSSC), software ($DJUSSW), electrical components & equipment ($DJUSEC), electronic equipment ($DJUSAI), recreational services ($DJUSRQ), travel & tourism ($DJUSTT), etc. These groups were laggards prior to ...

After a strong move in the week before this one, the Nifty spent the last five sessions largely consolidating in a very defined range. The markets traded with a weak underlying bias and lost ground gradually over the past few days; however, the drawdown remained quite measured and within the expected range. As the markets consolidated, the trading range got ...

Feeling a little anxious about the market, even with a strong economy? The truth is, money isn’t fleeing the market; it’s simply moving around, creating fresh opportunities. In this must-watch video, Tom Bowley of EarningsBeats eases those anxieties by providing charts that show this rotation. Tom shows clear signals of broad market participation, digging into the performance of key areas ...

This holiday-shortened week was anything but short on action! The S&P 500 and Nasdaq Composite closed at record highs, but what is really driving the market? In this essential recap, expert Mary Ellen McGonagle dives into the sectors and stocks making big moves. She’ll reveal why energy and financial stocks are heating up, discuss the surge in biotech and regional ...