The stock market’s action on Wednesday was a bit like trying to pick a dinner spot with friends—lots of back and forth, but no real direction. The market started out higher and went up and down without much of a directional bias until the Fed made its expected interest rate decision and Fed Chairman Jerome Powell’s press conference. Stock prices ...

Trump’s latest Hollywood “hit” isn’t the kind you stream. Threatening to slap a 100% tariff on films produced in foreign countries, the president’s announcement rattled several media stocks like Netflix, Inc. (NFLX), Walt Disney Co. (DIS), and others. What makes the whole thing complicated is this: No clear-cut definition of “foreign”: Many “American” films are shot abroad with foreign crews, ...

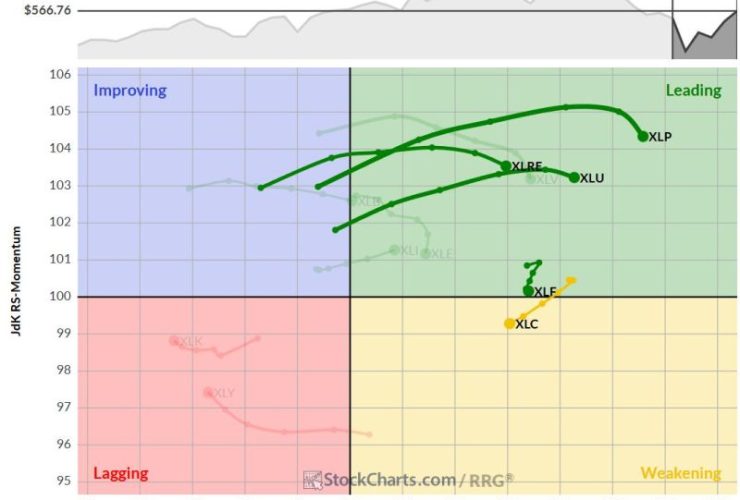

Communication Services Drops to #5 The composition of the top five sectors remains largely stable this week, with only slight adjustments in positioning. Consumer staples continue to lead the pack, followed by utilities, financials, real estate (moving up one spot), and communication services (dropping to fifth). This defensive lineup persists despite a rallying market, presenting an interesting dilemma for sector ...

In this video, Dave reveals four key charts he’s watching to determine whether the S&P 500 and Nasdaq 100 will be able to power through their 200-day moving averages en route to higher highs. Using the recently updated StockCharts Market Summary page, he covers moving average breadth measures, his proprietary Market Trend Model, offense vs. defense ratios, and the Bullish ...

The market does not always follow the same script or sequence, but bear markets typically end with a bottoming process marked by specific stages. These include capitulation, a short-term reversal-thrust, a follow-through thrust and long-term regime change. The first two stages mark downside excess and the initial turn around, while the latter two signal strong follow through. Today’s report will ...

I feel like the short-term risk is turning once again and I’ll explain why in my analysis below. Please don’t misunderstand. I suggested a bottom was in place a few weeks ago and I LOVE what has been happening in terms of manipulation/accumulation and I LOVE the fact that we were able to quickly regain both the 20-day EMA and ...

We just wrapped up a busy week jam-packed with key economic data and big tech earnings. And we have some positive news: the market held up pretty well. May is off to a good start. Strong earnings from META Platforms (META) and Microsoft (MSFT) gave the stock market a boost. Together, their strong performance helped the Nasdaq Composite ($COMPQ) break ...

With the major averages logging a strong up week across the board, and with the Nasdaq 100 finally retesting its 200-day moving average from below, it can feel like a challenging time to take a shot at winning charts. You may ask yourself, “Do I really want to be betting on further upside after an incredibly strong April?” When the macro ...

Riches are found in reactions—your reactions to changes in the markets. By this, I mean that if you spot a change in money flowing from one asset class to another, one sector to another, one industry to another, before the masses notice, you will be rewarded handsomely. My experience has been that your profits will accumulate dramatically and consistently. A ...

In the truncated week due to one trading holiday, the markets extended their gains and closed the week on a positive note. While remaining largely within a defined range, the Nifty continued consolidating above its 200-DMA while not adopting any sustainable directional bias. While the Index continued defending its key support levels, it oscillated in the range of 535.10 points. ...