Amid ever-increasing uncertainties on the global front and similarly rising geopolitical tensions between India and Pakistan, the Indian equity markets demonstrated strong resilience. They consolidated before ending the week on just a modestly negative note. The trading range remained modest; the Nifty oscillated in a 590-point range. While the markets defended their key support levels, the volatility surged. The volatility ...

In this insightful session, Grayson introduces the Traffic Light indicator, a unique tool available exclusively on the Advanced Charting Platform (ACP). Amidst the current volatility of the S&P 500, Grayson demonstrates how this indicator can help investors clarify trend directions and make more confident decisions. This video originally premiered on May 9, 2025. Click on the above image to watch ...

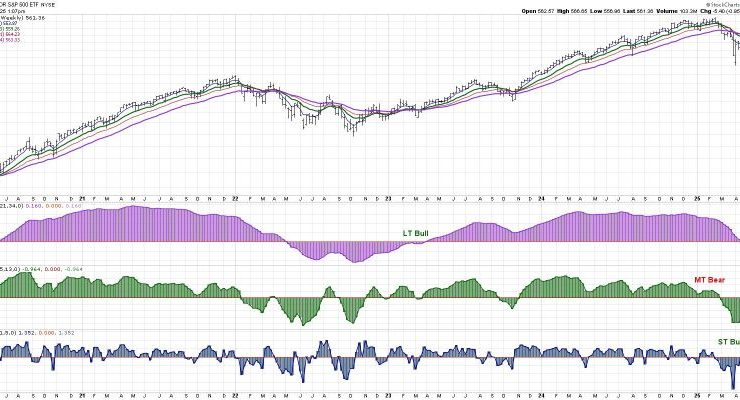

Last Friday, the S&P 500 finished the week just below 5700. The question going into this week was, “Will the S&P 500 get propelled above the 200-day?” And as I review the evidence after Friday’s close, I’m noting that the SPX is almost exactly where it was one week ago! That’s right–after all the headlines, tariff tantrums, and earnings reports, the S&P ...

When your investment portfolio isn’t gaining ground, it’s natural to feel uneasy, especially in a market that lacks direction. A headline-driven environment only adds to the uneasiness, making it more difficult to decide whether to buy, hold, or sell. This is a challenging situation for investors. The S&P 500 ($SPX) is still hovering close to its “Liberation Day” level, struggling ...

Want to know where the stock market is headed next? In this week’s market update, Mary Ellen McGonagle analyzes key resistance levels and reveals what’s fueling the current uptrend. She highlights top bullish setups among U.S. leadership stocks, plus global names showing strength. This video originally premiered May 9, 2025. You can watch it on our dedicated page for Mary Ellen’s videos. New ...

Is a recession coming? In this video, Julius breaks down the latest updates to his powerful Sector Rotation Model, analyzing four key macroeconomic indicators and their impact on sector performance. This video was originally published on May 9, 2025. Click on the icon above to view on our dedicated page for Julius. Past videos from Julius can be found here. #StayAlert, -Julius ...

Robinhood Markets, Inc. (HOOD) is back in the spotlight, wrestling with its four-year highs and turning heads on Wall Street. It debuted in 2021 as an IPO darling, capturing the imagination of young Gen Z traders before its dramatic fall as a meme stock fueled by crypto and an unhealthy dose of FOMO. Now, with year-to-date gains outpacing the S&P ...

The S&P 500 ($SPX) wrapped up Tuesday just below its intraday midpoint and posted one of the narrowest ranges we’ve seen in the past two months. That’s a clear sign traders are reluctant to take major bets ahead of Wednesday’s 2:00 PM ET Federal Open Market Committee (FOMC) decision. And honestly, this caution makes sense. If we look back at ...

With all eyes and ears on this week’s Fed meeting, it’s worth taking a big step back to reflect on conditions related to momentum, breadth, and leadership. And while the rally of the early April lows has been significant, the S&P 500 and Nasdaq 100 now face considerable resistance at the 200-day moving average. With that backdrop in mind, here ...

In this video, Joe shares how to trade MACD signals using multiple timeframes, and how to spot stock market pullback setups that can help to pinpoint a great entry off a low. He then reviews sector performance to identify market leadership, covers key chart patterns, and discusses a looming bearish signal on QQQ and IWM. The video wraps with technical ...